401(k)

Participating in a 401(k) savings plan is one of the best ways to help you build a solid financial future and retirement.

The Barnes Retirement Savings Plan comes with the following key features:

- Company match of 50¢ for every dollar you contribute up to 6% of your eligible pay.

- Save between 1% and 75% of your pay, up to annual IRS maximums.

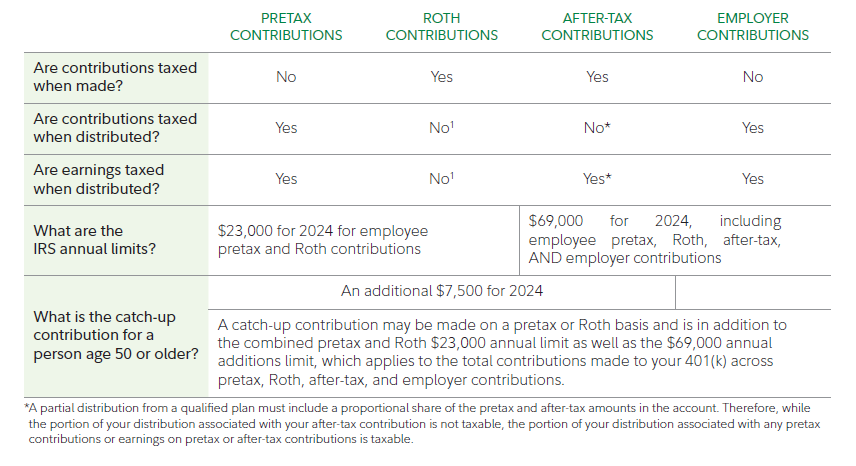

- Choose to save or increase your deferral with before-tax, after-tax and Roth contributions.

- You can manage your investment strategies over time with a broad spectrum of investment fund options.

- Plan loans and limited withdrawals are available in certain situations.

For more information regarding the Barnes Retirement Savings plan visit our Digital Plan Overview!

All full-time salaried and non-union hourly employees may join the plan on the first of the month following their date of hire. Part-time employees may join the plan after satisfying the service requirement.

Your contributions:

You can contribute up to 75% of your pay on a pre-tax and/or Roth basis to the plan, up to the annual IRS limit ($23,500 for 2025). If you are age 50 or older, you may be eligible for an additional “catch-up” contribution ($7,500 for 2025). When you enroll you specify a percentage of your pay.

You can change how much you are contributing at any time, effective within the next two payroll periods.

You may also contribute to the plan on an after-tax basis. After-tax contributions are not matched by the company.

Company contributions:

Eligible employees can receeive two types of employer contributions:

- Direct Company Retirement Contribution - An annual non-contributory Company contribution in the amount of 4% of your eligible compensation. For more information, please visit the Defined Contribution Plan page.

- Employer Matching Contribution - Barnes matches 50% up to the first 6% of your pre-tax and/or Roth contributions. You become entitled to (are vested in) the Company’s matching contribution after two years of service.

You are always fully vested in the value of your own contributions and any investment earnings on your contributions. You become vested in any Company contributions, plus any earnings on those contributions, after two years of service with the company.

Barnes offers a variety of investment options, from growth to stable value funds, bonds and blended fund investments.

Default Investment Option

If you do not make an investment election, your contributions and any Company contributions you may be eligible to receive will be invested in the Fidelity Freedom K® Fund that is targeted to your assumed retirement age (currently age 65) based on your date of birth.

If you are a new hire, your contributions will be invested in the age-based Fidelity Freedom K® Fund, unless you change your investment election. If you are a rehire who previously participated in the Retirement Savings Plan, your future contributions will be invested according to your most recent investment elections on file. If no elections exist on file, your contributions will be invested in the age-based Fidelity Freedom K® Fund, unless you change your investment election.

The investment risk of each Fidelity Freedom K® Fund changes over time as the fund's asset allocation changes. These risks are subject to the asset allocation decisions of the investment adviser. Pursuant to the adviser's ability to use an active asset allocation strategy for the Freedom Funds, investors may be subject to a different risk profile compared to the fund's neutral asset allocation strategy shown in its glide path. The funds are subject to the volatility of the financial markets, including that of equity and fixed income investments in the United States and abroad, and may be subject to risks associated with investing in high-yield, small-cap, commodity-linked, and foreign securities. No target date fund is considered a complete retirement program and there is no guarantee any single fund will provide sufficient retirement income at or through retirement. Principal invested is not guaranteed at any time, including at or after the funds' target dates.

You can make changes to how contributions and balances are invested as often as you like. For more information about your Retirement Savings Plan investment options, visit NetBenefits.

As a new hire, you will receive an enrollment package from Fidelity Investments within 30 days after your hire date.

We encourage you to set your 401(k) contribution, or otherwise elect to opt out of the plan amount within 60 days after your date of hire/rehire.

If you do not set your contribution, or elect to opt out of participation in the plan within 60 days of your hire/rehire date, you will be automatically enrolled in the Retirement Savings Plan with a pre-tax 401(k) contribution rate of 3% of your eligible regular pay. Please note: Any contributions that are made to the plan as a result of auto-enrollment will not be refundable if you elect to opt out of plan participation at a later date.

To learn more about your retirement benefits click here

To help protect the interests of fund investors in collectively seeking long-term returns on their investments, Fidelity monitors excessive trading and limits the number of times investors can move in and out of the particular funds subject to the Excessive Trading Policy. Short-term and other frequent trading by shareholders can adversely affect a fund’s performance by disrupting the portfolio manager’s investment strategy, increasing expenses (such as trading commissions), or allowing some investors to capitalize on stale pricing at the fund’s expense.

Within the Barnes Group Retirement Savings Plan, the Excessive Trading Policy restrictions apply to the following funds:

- Barnes Group Stock Fund

- Allspring Special Small Cap Value Fund - Class R6

- Fidelity Freedom® 2005 Fund - Class K6

- Fidelity Freedom® 2010 Fund - Class K6

- Fidelity Freedom® 2015 Fund - Class K6

- Fidelity Freedom® 2020 Fund - Class K6

- Fidelity Freedom® 2025 Fund - Class K6

- Fidelity Freedom® 2030 Fund - Class K6

- Fidelity Freedom® 2035 Fund - Class K6

- Fidelity Freedom® 2040 Fund - Class K6

- Fidelity Freedom® 2045 Fund - Class K6

- Fidelity Freedom® 2050 Fund - Class K6

- Fidelity Freedom® 2055 Fund - Class K6

- Fidelity Freedom® 2060 Fund - Class K6

- Fidelity Freedom® 2065 Fund - Class K6

- Fidelity® Blue Chip Growth Commingled Pool

- Fidelity® Diversified International K6 Fund

- Fidelity® Equity-Income K6 Fund

- Fidelity® Total International Index Fund

- Fidelity® U.S. Bond Index Fund

- John Hancock Funds Disciplined Value Mid Cap Fund Class R6

- MFS Mid Cap Growth Fund Class R6

- Principal SmallCap Growth Fund I Class R-6

- Western Asset Core Plus Bond Fund Class IS

Details of the Excessive Trading Policy

Fidelity’s monitoring is based on the concept of a “roundtrip” within a restricted fund. A roundtrip transaction is when a participant exchanges in and then out of a fund option subject to the Excessive Trading Policy within 30 days.

For the purposes of the Excessive Trading Policy, exchanges do not include systematic contributions or withdrawals (that is, regular contributions, loan payments, hardship withdrawals) as permitted by the Plan; they only include participant-initiated exchanges greater than $1,000.

Under the excessive trading policy, participants are limited to one roundtrip transaction per restricted fund within any rolling 90-day period, subject to an overall limit of four roundtrip transactions across all funds over a rolling 12-month period.

For the restricted funds listed above, the first roundtrip in any fund results in a warning letter. Participants with two or more roundtrip transactions in a single fund within a rolling 90-day period will be blocked from making additional exchanges to that fund for 85 days. Any four roundtrips in one or more funds in that plan account in a 12-month rolling period will result in the participant being limited to one exchange day per calendar quarter for 12 months. Once the 12-month exchange limitation expires, any additional roundtrip in any fund in the next 12-month period will result in another 12-month limitation of one exchange day per quarter.

Trading suspensions do not restrict a participant’s ability to make investment exchanges out of a fund. In other words, the right to redeem is not affected by these policies, but the ability to make subsequent exchanges into the fund will be. Fidelity continues to reserve the right, but does not have the obligation, to reject any purchase or exchange transaction at any time, as provided for in prospectuses and other governing documents for its mutual funds and other investment products. Fidelity continues to reserve the right to amend its excessive trading rules in the future.

The Barnes Group Retirement Savings Plan allows the Benefits Committee to take action if frequent trading by a participant in any plan investment option has been identified. As an example, the action may be a temporary or permanent suspension of trading from one or more funds where the frequent trading has occurred.

If you need access to your Retirement Savings Plan contributions before you retire, you can:

- borrow against your account by taking out a loan

- withdraw after-tax dollars and their investment proceeds; or

- withdraw before-tax dollars and rollover contributions on a hardship basis.

The terms, restrictions and penalties associated with each option are generally described further below. To initiate a withdrawal call the Retirement Benefits Line at 1-800-835-5095 or log on to Fidelity NetBenefits® at www.fidelity.com.

Loans are available from a portion of your vested account balance. Your vested balance that is available with respect to loans includes your contributions (including any rollover contributions) and the vested portion of the Company match, but excludes funds contributed to a profit sharing or 4% Defined Contribution retirement account. Here are some guidelines:

|

The Loan Cap is adjusted if you already have a loan outstanding. The adjusted Loan Cap is the smaller of two amounts:

- 50% of your vested balance (which includes the value of your outstanding loan or loans), minus the outstanding balance of your loan or loans, and

- $50,000, minus the highest outstanding balance of your loan or loans within the past 12 months.

In return for postponing taxes on before-tax contributions to the Savings Plan, the government limits withdrawals prior to age 59 1/2 to hardship situations. You will pay income tax on the funds when they are withdrawn.

Under IRS rules, hardship withdrawals are limited to your before-tax deferrals (and investment earnings on such deferrals through December 31, 1988). Withdrawals of such amounts are limited to cases in which you can show that you have an immediate and heavy financial need due to any of the following circumstances:

- deductible medical expenses incurred by yourself, your spouse or your dependents and not covered by medical insurance

- the cost of purchasing your principal residence (excluding mortgage payments)

- tuition and related education expenses (including room and board expenses) for the next 12 months of post-secondary education for yourself, your spouse or your dependents

- expenses necessary to prevent your eviction from your principal residence or to prevent the foreclosure on the mortgage of your principal residence

- funeral or burial expenses for your deceased parent, spouse, children or dependents

- expenses for the repair of damage to your principal residence that would qualify for the casualty deduction under Internal Revenue Code Section 165.

If you are eligible to borrow under the Savings Plan, you must first apply for a loan to satisfy your financial need prior to being eligible to apply for a hardship withdrawal. You must also have obtained all distributions (including dividend distributions) and all non-taxable loans available under the Savings Plan or any plan maintained by the Company or any affiliate. You may request that any hardship withdrawal be increased so as to include any federal, state or local income taxes or penalties which are expected to be due as a result of the withdrawal.

- You may not request more than two hardship withdrawals in any calendar year.

- Once you receive a hardship withdrawal, you will be excluded from contributing to the Savings Plan for a period of six months.

- Withdrawals will be divided equally among all your investment funds under the Savings Plan.

- You must withdraw all after-tax contributions before any before-tax contributions can be withdrawn.

- Contributions made through the Company Match, PAYSOP or Profit Sharing or Retirement contributions may not be withdrawn while you are employed by the Company. Amounts in your Rollover Contributions Account may also be withdrawn in accordance with the hardship distribution rules.

While you are still working at the Company, you may withdraw all or a portion of your accounts attributable to your own before-tax contributions and rollover contributions (other than any Rollover Contributions made to the Barnes Group Inc. Profit Sharing Retirement Plan) and investment earnings on such contributions beginning at age 59-1/2. To make a withdrawal, log on to Fidelity NetBenefits® at www.fidelity.com or call the Retirement Benefits Line at 1-800-835-5095. You may withdraw shares of Barnes Group Common Stock from your account, if applicable, or you may elect to receive cash based on the value of Barnes Group Common Stock held in your Accounts at the time of distribution.